-Darren Leavitt, CFA

It’s been a difficult month for investors, and sentiment indicators tell that story. Wall Street appeared poised to build on the prior week’s gains, but regressed again as mixed signals on tariffs and a loss of sentiment gave reason to sell. Early in the week, rhetoric on a more targeted approach to tariffs was met with optimism. However, a 25% levy on all imported autos, scheduled to take effect on April 3rd, rattled the auto sector and contradicted early thoughts that the auto sector would avoid blanket tariffs. Trump’s “Liberation” Day is also set for April 2nd, at which time it is widely expected that the administration will impose reciprocal tariffs on all nations. Inflation fears related to tariffs were top of mind in the sentiment data released this week, and concerns regarding future employment were also conveyed in the surveys. These concerns may lead to a pullback in discretionary spending, which will, in turn, ultimately affect corporate earnings. More curbs on technology exports hurt the Semiconductor and Information Technology sectors. Disappointing news from KB Homes and Lennar also cast a shadow on the home builders.

It’s been a difficult month for investors, and sentiment indicators tell that story. Wall Street appeared poised to build on the prior week’s gains, but regressed again as mixed signals on tariffs and a loss of sentiment gave reason to sell. Early in the week, rhetoric on a more targeted approach to tariffs was met with optimism. However, a 25% levy on all imported autos, scheduled to take effect on April 3rd, rattled the auto sector and contradicted early thoughts that the auto sector would avoid blanket tariffs. Trump’s “Liberation” Day is also set for April 2nd, at which time it is widely expected that the administration will impose reciprocal tariffs on all nations. Inflation fears related to tariffs were top of mind in the sentiment data released this week, and concerns regarding future employment were also conveyed in the surveys. These concerns may lead to a pullback in discretionary spending, which will, in turn, ultimately affect corporate earnings. More curbs on technology exports hurt the Semiconductor and Information Technology sectors. Disappointing news from KB Homes and Lennar also cast a shadow on the home builders.

The S&P 500 fell 1.5%, the Dow lost 1%, the NASDAQ tumbled 2.6%, and the Russell 2000 shed 1.6%. Notably, the S&P 500 has traded back below its 200-day moving average, which will now serve as technical resistance for the index. Shorter tenured US Treasuries outperformed the longer end of the curve. The 2-year yield declined by four basis points to 3.91%, while the 10-year yield increased by one basis point to 4.26%. Oil prices gained 1.5% or $1.07 to close at $69.34 a barrel. Gold prices surged by 3% or $91.3 to ink another all-time high at $3,113.40 an Oz. Copper prices remained elevated, gaining $0.03 to $5.15 per Lb. Bitcoin’s price fell by 2% to close the week at $82,698. The US Dollar index gained 0.1%, closing at 104.02.

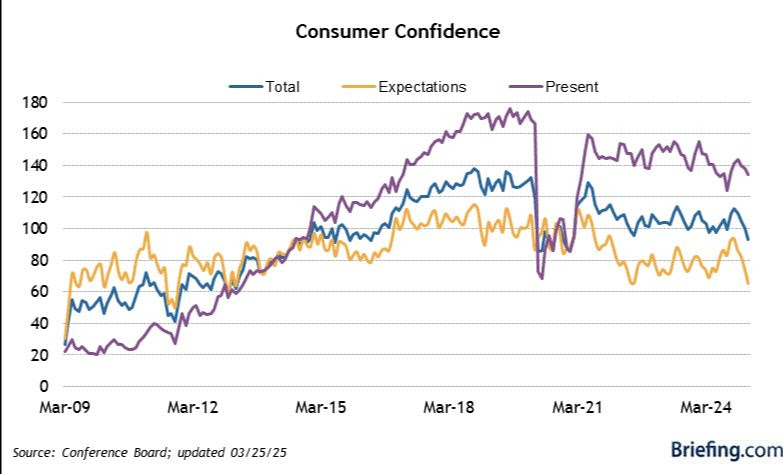

The Economic calendar was highlighted by two sentiment surveys and the Personal Consumption Expenditure report. Consumer Confidence fell to 92.9 in March, down from 100.1 in February, marking the fourth consecutive month of declines. The Expectations component of the survey fell to 65.2 from 74.8, the lowest level seen in twelve years. Similarly, the final reading of the University of Michigan’s Consumer Sentiment Index fell off a cliff, coming in at 57 versus an estimated 57.9. The survey is off 30% since November of 2024. Inflation and employment were cited as the major concerns in both surveys, casting a shadow on discretionary spending. The PCE, the Fed’s preferred measure of inflation, increased by 0.3% in February and was up 2.5% year-over-year, in line with January. The Core reading, which excludes food and energy, increased by 0.4% and rose to 2.8% in February, up from 2.7% in January. Personal Spending increased by 0.4%, shy of the consensus estimate of 0.6%. Personal Income rose by 0.8%, well above the street’s expectation of 0.4%. Initial Claims fell by 1k to 224k, while Continuing Claims fell by 25k to 1.856M. The S&P Global Manufacturing PMI fell into contraction, with a reading of 49.8, down from 52.7. The S&P Global Services PMI increased to 54.3 from the prior reading of 51.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.